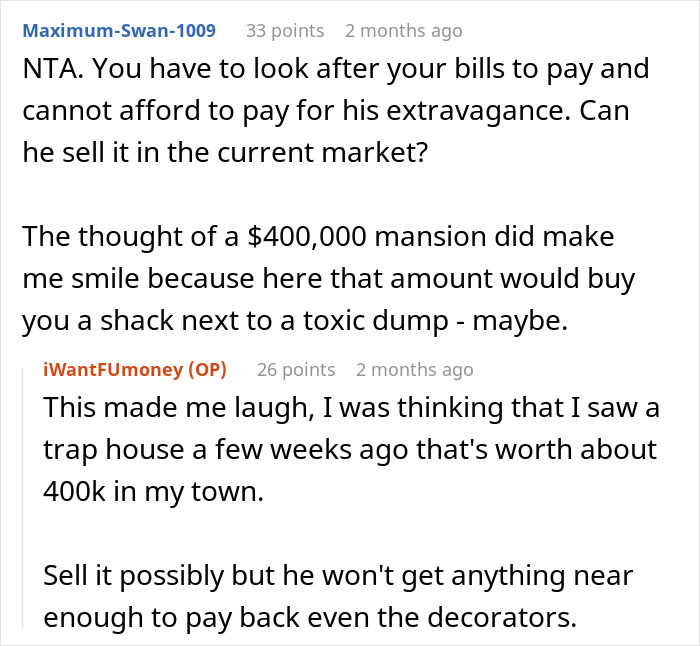

“More money, more problems,” rapped The Notorious B.I.G. once upon a time. And it seems not much has changed since then. Money can cause some serious issues, especially between friends and family. Whether it’s arguments over an inheritance or relatives not paying back loans, there’s no shortage of stories about financial family feuds.

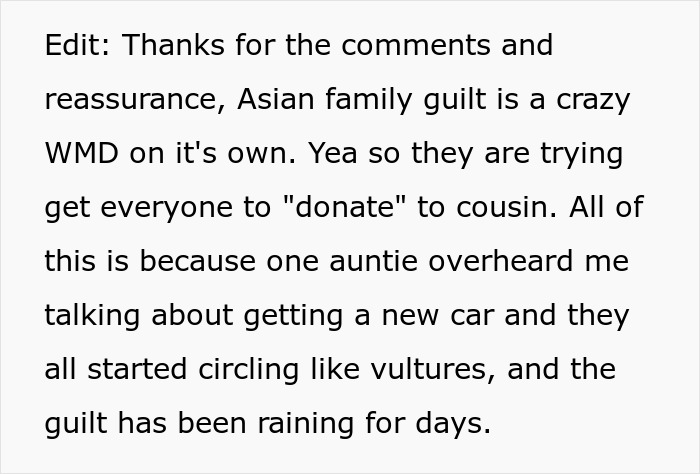

One man had a fall-out with his cousin over inheritance and they’re no longer speaking. So imagine his surprise when he was inundated with calls from family members years later, nagging him to “donate” his hard-earned savings to that same cousin. The cousin had gone against advice and bought a “ludicrously expensive house” that he couldn’t afford. Now, relatives want the man to help him pay his debt, but he’s not sure if he should.

The man says he warned his cousin not to buy the expensive house a few years ago, and told him he’d regret it if he did

Image credits: Jakub Zerdzicki / pexels (not the actual photo)

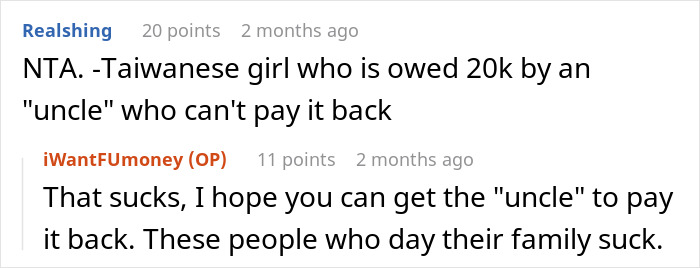

But the cousin’s wife wanted the house, so he went ahead and committed to a mortgage that he couldn’t really afford

Image credits: Nicola Barts / pexels (not the actual photo)

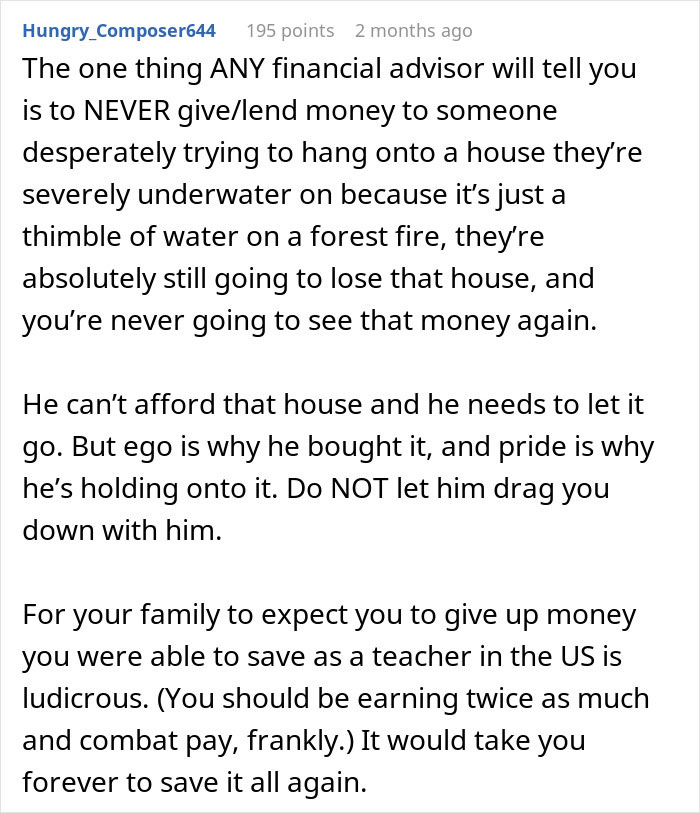

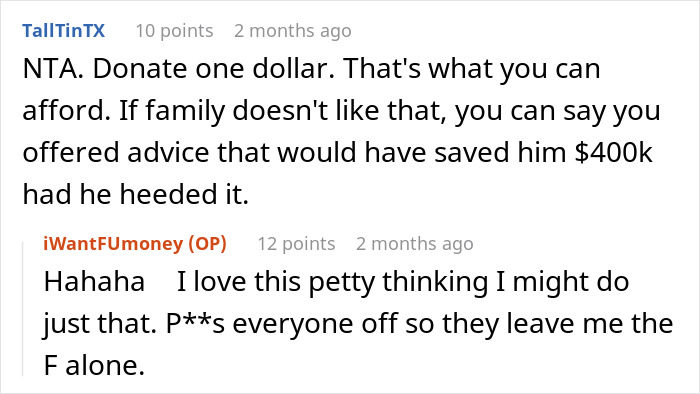

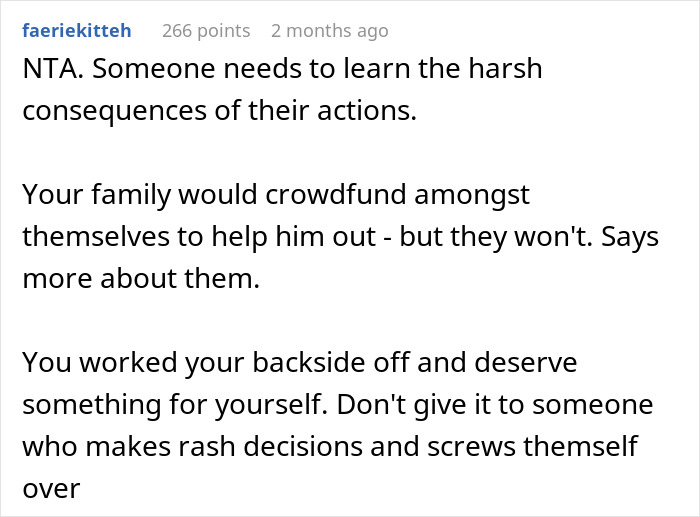

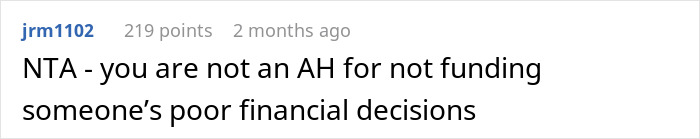

Image credits: iWantFUmoney

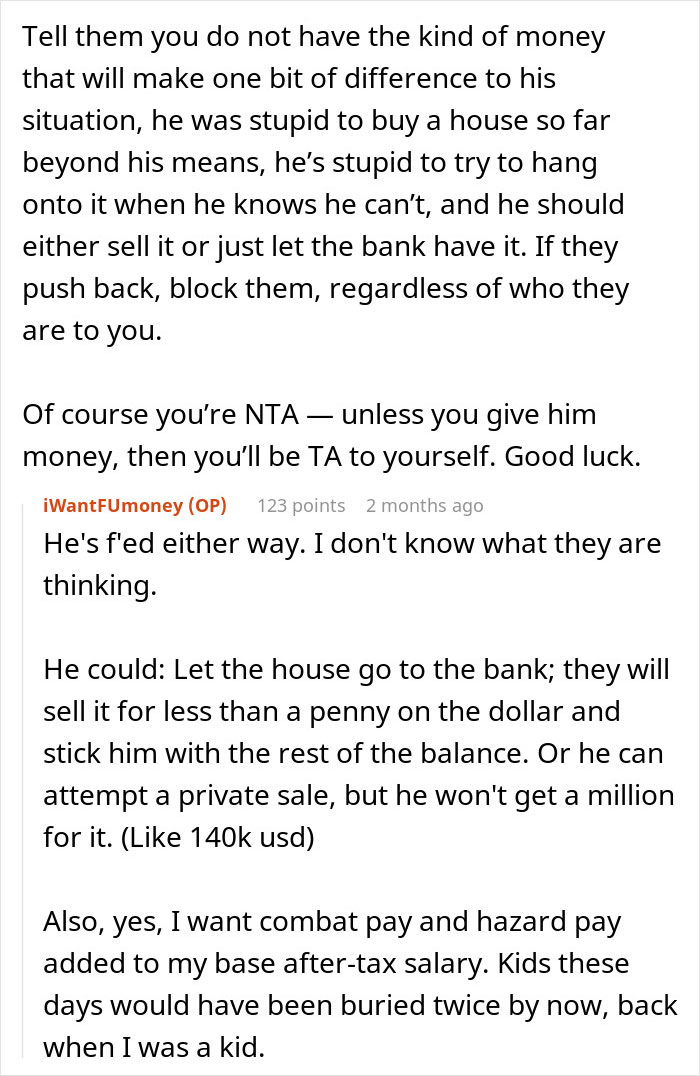

Experts say helping someone else out should never leave you in a tight spot

Finance and Investment site Investopedia advises that lending money to friends and family requires careful planning. “Lending money to family and friends can be a gesture of goodwill when someone you know is in a tight spot financially, but it can be problematic if your efforts to help lead to disagreements or you experience financial issues as a result,” reads their website.

A 2019 Lending Tree survey, found that almost a third of those polled had a bad experience after lending money to friends or family. More than a third hadn’t been paid back. While just under a quarter regretted their decision to help. Monthly housing costs and vehicle expenses were the top reasons people borrowed money.

Investopedia says it’s important to consider how lending money to a relative could impact your own financial situation. “For instance, if lending money to someone would put a strain on your own finances and make it difficult to keep up with your bill payments, it’s probably not the best move,” warned Investopedia. “On the other hand, if you have a sizable emergency fund, little or no debt, and you’re getting a steady paycheck, making a loan might not be as difficult to manage.” In the case of the OP, he can’t afford to buy a house of his own, and had been saving for a car.

The OP used the word “donate”, which implies his family expects him to gift the money to his cousin, with no expectation of getting it back

If he goes ahead and donates his savings, he might end up paying more than he initially expected. Experts warn there can be tax implications when it comes to gifting money to someone. According to Edelman Financial Engines, “gifts of more than $18,000 per person per year could make you (not the person receiving the gift) subject to the federal gift tax”. There are no tax implications with loans because you’re (supposed to) get the money back.

But it’s crucial to have a contract in place. “The IRS considers money you lend to a family member to be a loan only if you sign a loan agreement, charge interest and try to collect (to the point of hiring a debt collector or taking the borrower to court),” cautioned the company. “If you fail to meet all three requirements, the IRS can say your loan was actually a gift that’s subject to the gift tax.”

The cousin was already struggling with payments before Covid but the fallout from the pandemic made things worse

He’s one of millions who fell behind on mortgage payments because of Covid. A 2021 report by the Consumer Financial Protection Bureau stated that “since the beginning of the COVID-19 pandemic, the number of borrowers who are behind on their mortgage has increased to a level not seen since the height of the Great Recession in 2010.”

Many people entered what’s known as forbearance. It’s when a bank lets you temporarily stop paying your loans. The report found that ”a year into the pandemic, a significant share of mortgage borrowers remained in forbearance programs or had delinquent loans.” It further stated that those who were already struggling before the pandemic were likely to battle to get back on their feet and could risk losing their homes.